Post-Merger Integration

Doing M&A Right Means 2 + 2 > 4

Preparation is key to creating, rather than destroying, value in an integration. L.E.K.'s global post-merger integration (PMI) specialists work with our sector teams to ensure you receive a seamless service across the deal life-cycle, from large-scale, global deals to mid-market and smaller transactions. The result is a smooth close and a combined entity that is worth more than the sum of its parts.

How M&A can go wrong

Winning acquirers put the right M&A strategy in place, get the acquisition price right and use a structured post-merger integration approach to capture revenue, cost and capital synergies. However, on average, mergers and acquisitions tend to destroy shareholder value. This can be due to a variety of missteps, including:

-

Not defining a clear objective: It’s important to be clear about why you’re doing the deal in the first place. Is it to drive growth? Harness the capabilities of the combined entity? Optimize cost and scale? The objective is the launching pad for the overall strategy

-

Insufficient planning: Embarking on a deal without preparing your organization ahead of time can have a whole range of negative ramifications

-

Overpaying: Paying a price that is not grounded in market or operational realities can end up defeating the purpose of the deal

-

Underestimating what it will take: The complexity and timing associated with achieving synergies can be substantial

-

Lack of discipline: Not instituting a disciplined, structured post-merger integration approach focused on deal value drivers

-

Overlooking key competency: Failure to capture the learnings and developing a competency in M&A

Our merger integration tools and services

L.E.K.’s PMI practice has deep experience with successful acquisition integration. This includes assessing revenue and cost synergy potential, "Clean Team" support, negotiation support, pre-close planning and analysis, post-close integration support, carve-out strategy and approach planning, and the creation of transition service agreements. We advise our clients across a broad range of activities to ensure they have the best available insights heading into a deal. We combine these with the appropriate planning and a structured approach that is aligned with each client’s key success factors.

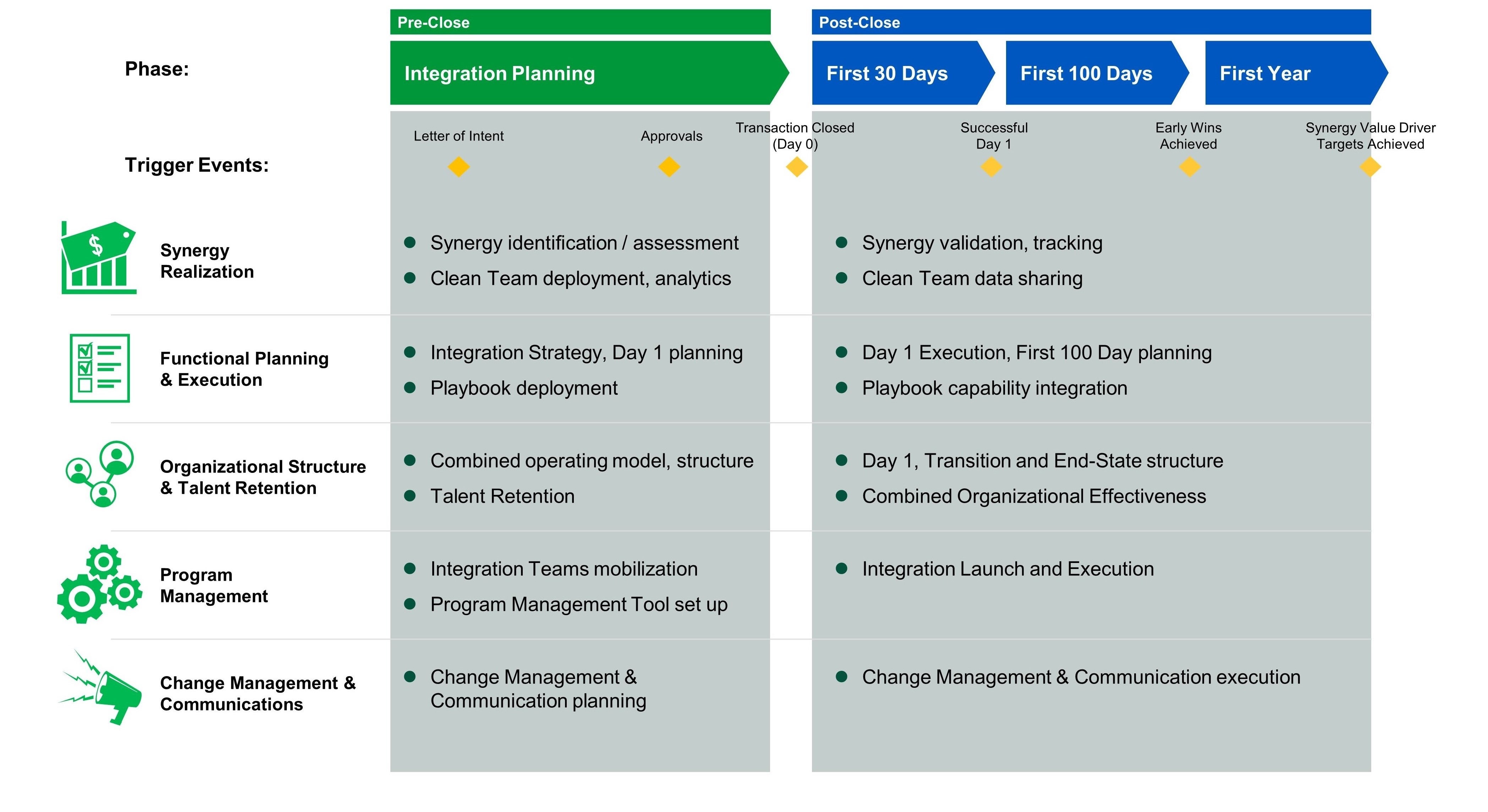

L.E.K. PMI framework

Our suite of proven tools, as well as our deep sector expertise and proven Organizational Design and Value Activation methods allow us to accelerate any integration project:

-

Synergy realization: We combine deep industry expertise with world-renowned analytical capabilities and robust tracking tools to assess deal synergies.

-

Functional planning and execution: To get our clients up and running quickly, we have developed industry-specific functional integration playbooks.

-

Organizational structure and talent retention: Tapping into our Organizational Strategy practice, we bring the latest tools and techniques to help clients develop an effective, combined organization, while holding on to their critical resources.

-

Program management: Leveraging a cutting-edge, cloud-based toolset and robust Value Activation approach, we ensure our clients deploy a disciplined and structured approach to integration.

-

Change management and communications: Using our well-established communication program, we can ensure internal and external stakeholder concerns are addressed.

Our global post-merger integration team advises on a wide variety of transactions, from large-scale, global integrations to mid-market, carve-out and PE-backed deals, across all our sector verticals.

-

Large cap deals: Our experts understand the complexities of integrating companies across regions and countries and can deploy global, coordinated teams to support our clients’ needs.

-

Mid-market deals: We bring added structure, focus and speed. We deploy deep strategic, commercial, organizational and operational expertise to help integration teams identify and evaluate synergy opportunities and develop the integration plans to realize transaction value.

-

PE-backed deals: Whether it’s a 100 Day plan for a single acquisition, integration of “buy and build” assets or a carve-out, we can deploy a fit-for-purpose approach that focuses on rapid value creation and long-term capability development.