Overview

Retail is complicated and getting more so. Ecommerce and omnichannel retail raise the stakes in a crowded market. Margin pressures send stores in search of ways to fine-tune their supply chains, boost staff utilization, and streamline the middle and back offices. Meanwhile, cybersecurity threats continue to target consumer data — the very data essential to providing a differentiated consumer experience.

All this spells opportunity for specialized solution providers whose products and services can pick up where a retailer’s traditional strengths leave off. But the complexity that’s creating the need for retail support services can also make the market for them hard to navigate.

Let L.E.K. Consulting break it down. We’re familiar with the end-user perspective, thanks to our long history of working with retail and consumer products companies. We can bring our growth strategy, channel strategy, pricing strategy and performance improvement capabilities to bear in helping solution providers prioritize the tactics they need in order to win. And if inorganic growth is on the table, we can add our transaction support services to the mix.

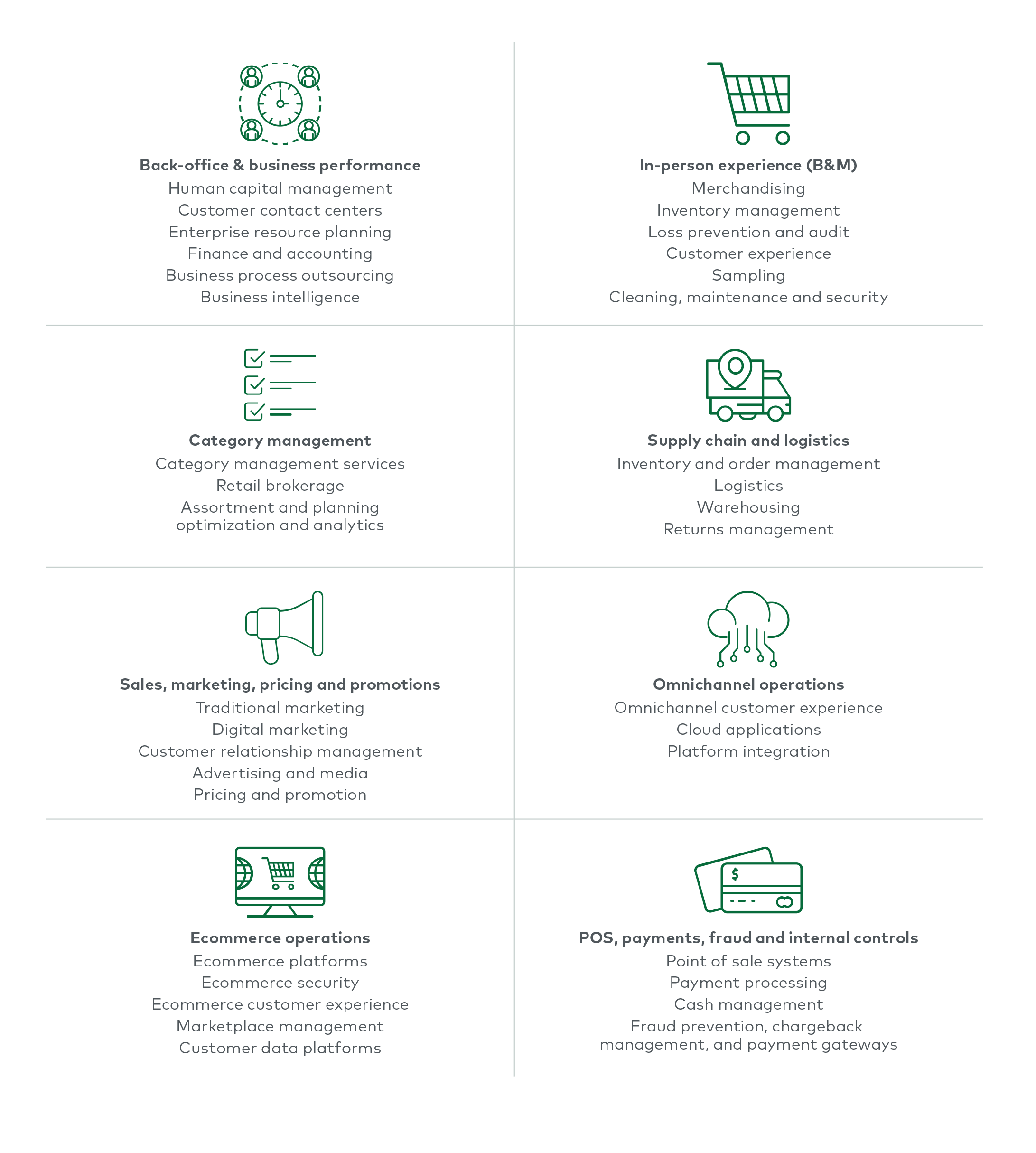

We work with solution and service providers in every segment of the retail support industry, including:

Key questions and challenges

Our professionals collaborate with private equity clients to answer questions such as:

- What is the ongoing customer need for the product or service? What are the nuances of different market segments?

- How healthy is the overall market today? Where is consolidation taking place?

- Who are the established and up-and-coming players? What are their relative strengths?

- What does the company’s reputation look like among users and industry experts?

- How does the product or service stack up against key purchasing criteria?

- How loyal are customers? What would it take to keep current customers and acquire new ones?

- What are the most attractive growth opportunities? How are consumer preferences likely to evolve?

We also help retail support providers, as well as retailers looking to outsource, get answers to questions like:

- Which functions are better suited to outsourcing given our business objectives and operating model?

- Are there untapped opportunities to expand to adjacent and international markets?

- What are the most promising customer segments to target?

- How can we improve efficiency and speed to market while delivering a seamless customer experience?

- What pricing strategies can help us increase our margins or market share?

- How can we evolve our organization and solution portfolio to support customer outcomes? What are the value propositions that resonate, and how can we deliver on them more effectively?

- What is our digital footprint, and where does it need to be in order to meet customer expectations and stay ahead of the competition?

- What insights do we need to make better decisions? How can we enable decision-makers to tap into those insights on demand?

Successes

Corporate client breaks into retail, food and CPG brokerage

This corporate client was interested in entering the retail, food and CPG brokerage market. We evaluated the core brokerage market — selling and distribution — and compared it with what a similar salesforce could deliver in other types of brokerages such as marketing and merchandising. Finally, we built a strategic road map of the client’s next steps.

National off-price retailer sizes up expansion into reverse logistics

A leading off-price retailer was thinking about expanding into the U.S. reverse logistics market. To help them decide, we completed a sweeping analysis of the market, including an estimate of its size. We also identified the investment upside opportunity for our client along with the capabilities they would need to compete in that space.

Retail fixture manufacturer reorients around the customer

To support their ambitious growth objectives, we helped this leading maker of retail fixtures change their organizational structure to a customer-centric model. We also worked with them to streamline the quote-to-delivery process, clarifying each stakeholder’s role and defining accountability for each step of the process.

Private equity investors evaluate ecommerce for grocers

A leading provider of ecommerce platform solutions to the grocery sector drew the interest of a private equity group. To help the group determine whether to invest, we carried out commercial due diligence on the platform provider. In addition, we interviewed key decision-makers to understand their process for selecting similar solutions. We followed up by providing a view of the market size, growth and industry competitive landscape.

Maker of POS hardware products gets a strategy for success

A provider of point of sale hardware products and support services sought a new direction for their business. We kicked off with an analysis of the opportunities and threats facing the provider. Then we developed a set of strategic options for our client, identified the optimal strategy and built a financial model around the new strategy. Finally, we recommended that our client focus on select specialty retail end-markets and seek out a POS software vendor to acquire.

B2B provider rethinks market for direct print and mail business

A provider of direct printing and mailing solutions faced declining volumes in a stagnant market. To help them evaluate their options for a sale, we worked with senior management to outline three primary strategic objectives. After that, we defined the underlying market conditions and future trends. With this information, we developed a list of prioritized growth initiatives, including detailed execution plans.